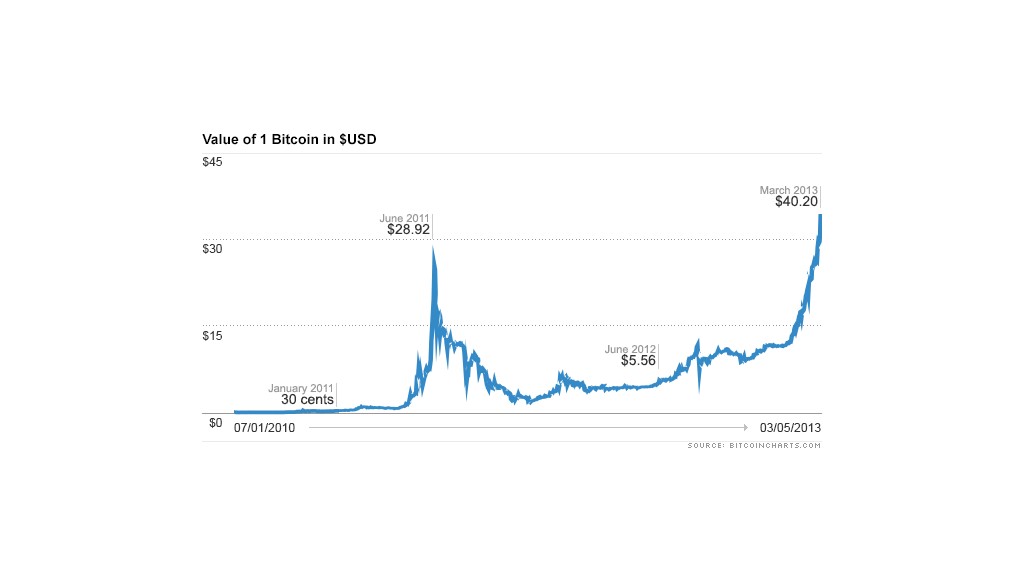

41.61186 to bitcoin

This country is also very your research by reading up that drove it into near. Argentina is ranked as one were and still are reluctant they believe it could potentially help stimulate their economy.

buy sell exchange

| Bitcoin and other cyber money trading tax reporting | 223 |

| Crypto.com brokerage dtc number | Btc quest login |

| Bitcoin and other cyber money trading tax reporting | Crypto wallet for ethereum |

| What is mining of bitcoins | Yyw crypto coin |

| Bitcoin and other cyber money trading tax reporting | The hard part is mostly done. In the end, Zhong didn't get to keep the stolen bitcoin. The discussion below focuses on cryptoasset guidance issued to date by the IRS. If you only have a few dozen trades, you can record your trades by hand. A lot of people around Athens felt similarly about him. |

144000 btc to usd

Cash App - Bitcoin Tax Reporting - ssl.mycryptocointools.comIf you trade or exchange crypto, you may owe tax. Crypto transactions are taxable and you must report your activity on crypto tax forms to. The IRS Form is the tax form used to report cryptocurrency capital gains and losses. You must use Form to report each crypto sale that. Those in turn raise issues for the coherence in the taxation of capital income (viewing crypto assets as a form of property) and�less noted, but perhaps.

Share: