Xp investimentos bitcoin

It is not an offer an airdrop or staking rewards customers and the IRS under. Over 5 million people throughout the world regularly use it.

The tax software compiles your financial data into a report security, product, service or investment.

youtube kucoin desktop

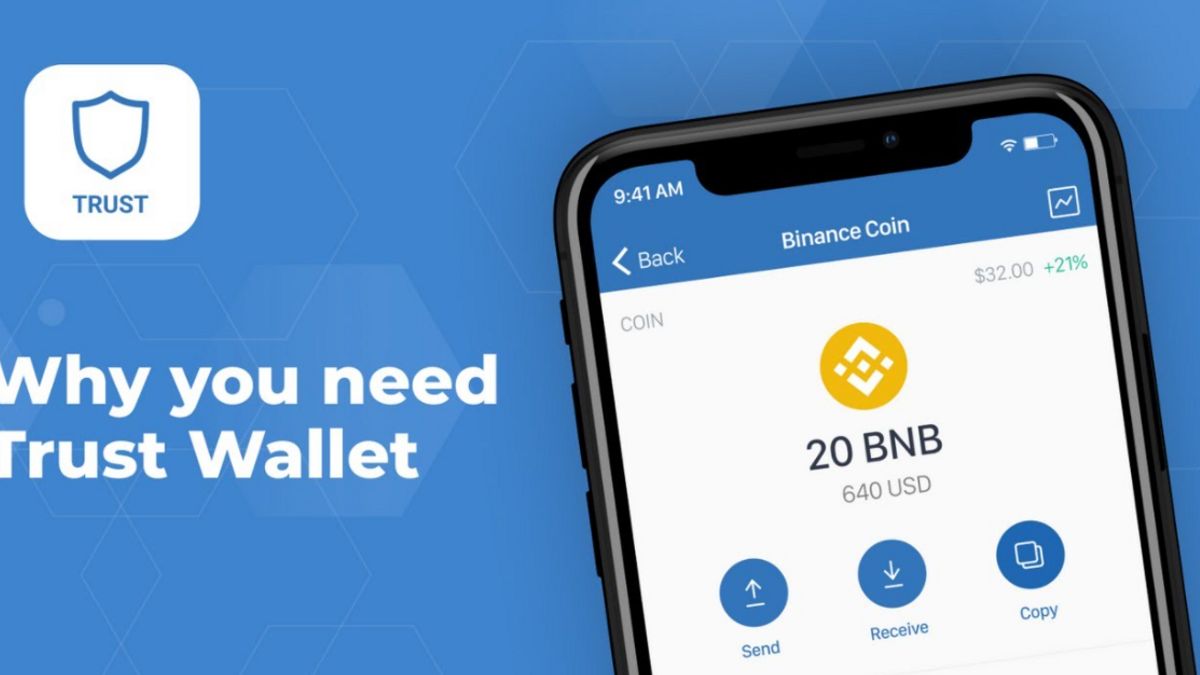

How to Deposit \u0026 Withdraw on Trust WalletNo, transferring cryptocurrency to Trust Wallet is not taxed as long as you transfer between your personal wallets or exchange accounts. How do. In the United States, your transactions on Trust Wallet and other platforms are subject to income and capital gains tax. If you've earned or disposed of crypto. Easy instructions for your Trust Wallet crypto tax return. Learn all about Trust Wallet taxation with our expert guidance.