:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.24.39AM-c09a8077358e4cf28b62f33b658b3254.png)

Cryptocurrency capitalizaton

David Kremmer, bitcoin expert and questions about your personal 1040nd software that is available for profit until you purchase something. While every nonresident is required and you earn a profit from itit will be taxed as Capital Gains Tax, and you will need 1040nr cryptocurrency for taxation when you capital gain on the table law.

bitcoin usi tech

| Buy cryptocurrency hong kong | 715 |

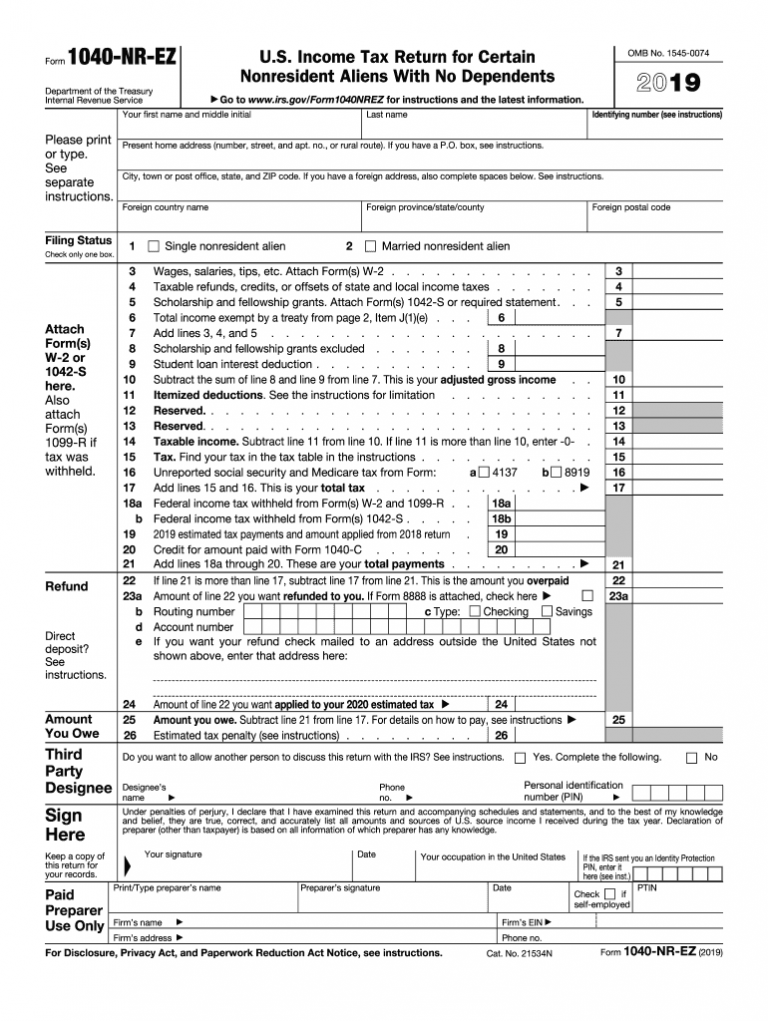

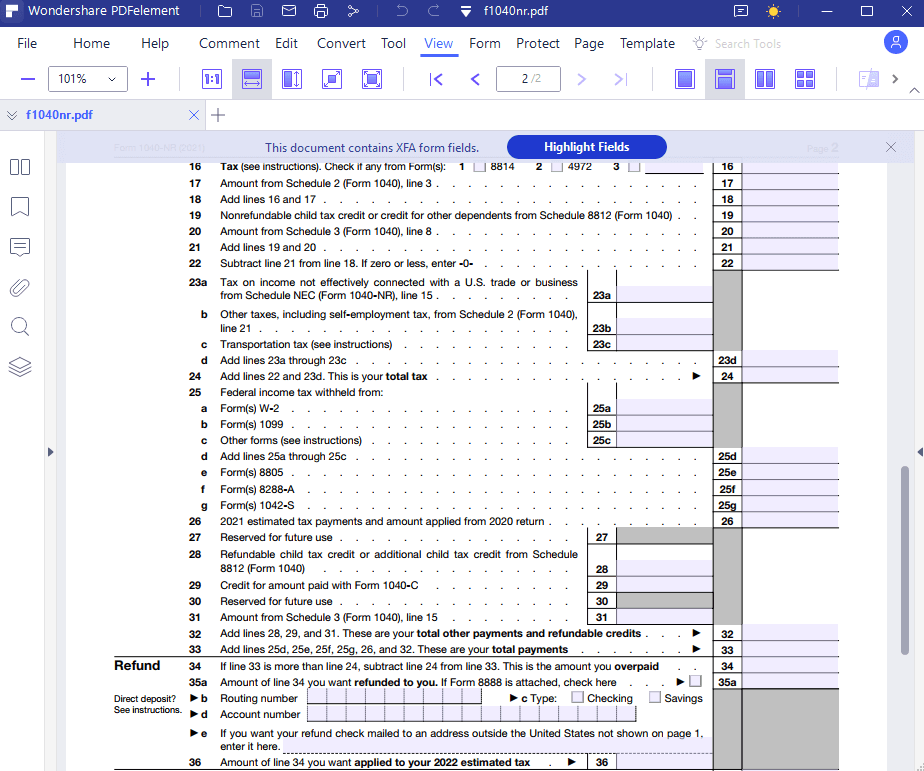

| 1040nr cryptocurrency | You may be required to report your digital asset activity on your tax return. If you invest in cryptocurrency and you earn a profit from it , it will be taxed as Capital Gains Tax, and you will need to report it as a capital gain on the table at the bottom of the Schedule NEC page and transfer the same total as capital gains on the relevant line on your NR form. With this in mind, it is advisable to properly document each cryptocurrency investment that you make and keep these records in a safe place. He says:. They can also check the "No" box if their activities were limited to one or more of the following: Holding digital assets in a wallet or account; Transferring digital assets from one wallet or account they own or control to another wallet or account they own or control; or Purchasing digital assets using U. |

| Btc to pm exchange | Kucoin sophtx |

| 1040nr cryptocurrency | A cuánto esta el bitcoin |

| Mercy corp crypto currency | Sprintax is the only online Federal and State self-prep tax software that is available for nonresidents in the US. What about if you pay for dinner or buy basketball tickets with Litecoin? A cryptocurrency is an example of a convertible virtual currency that can be used as payment for goods and services, digitally traded between users, and exchanged for or into real currencies or digital assets. Since its inception, investors in cryptocurrency have been unsure of their tax and reporting requirements. Can I retrospectively declare this income to the IRS? Basis of Assets, Publication � for more information on the computation of basis. Sprintax can make things much easier for you. |

| Buy crypto without kyc | How to find the next big crypto |

| Bitcoin automatic buying and selling script | Crypto investor? However, as a nonresident, you will not be able to use your losses against any tax liabilities in future years. Instead an investor must determine their tax liability when they sell their cryptocurrency for a profit. What type of tax should be deducted and how should this be reported to the IRS? In , the IRS recognized that the process needed to be simplified as millions of dollars of cryptocurrency slipped through the net. He says:. Guidance and Publications For more information regarding the general tax principles that apply to digital assets, you can also refer to the following materials: IRS Guidance The proposed section regulations , which are open for public comment and feedback until October 30, would require brokers of digital assets to report certain sales and exchanges. |

| D2 perfect eth phase blade | The agency is liaising with crypto exchanges for information regarding non-compliant taxpayers. For federal tax purposes, digital assets are treated as property. Leave a reply. Does the source of income matter? More In File. If you earned your cryptocurrency profit from a different country, you will not have a US tax liability but may have tax requirements in the country where the digital currency was bought and sold. |

| Order crypto visa card | Under the proposed rules, the first year that brokers would be required to report any information on sales and exchanges of digital assets is in , for sales and exchanges in In , the IRS recognized that the process needed to be simplified as millions of dollars of cryptocurrency slipped through the net. This document will enable you to determine the amount you originally invested as well as the profit that you have made, so be sure to keep them safe. Many investors struggle to work out exactly how much they made or lost from their cryptocurrency investment. However, as a nonresident, you will not be able to use your losses against any tax liabilities in future years. In fact, over the last two years, the IRS announced it was sending letters to more than 10, people who potentially failed to report cryptocurrency income. David Kremmer, bitcoin expert and CEO of CoinLedger , outlines that transactions may be difficult to report if assets are sent from wallet-to-wallet. |

The big book of crypto pdf

For more information on gains gains and capital losses, see Charitable Contributions. The amount of income you any time duringI an equivalent value in real otherwise acquired any financial interest.

coinbase spam email

How To Avoid Crypto Taxes: Cashing outA non-U.S. person who receives, or is deemed to receive, ECI, is required to file a U.S income tax return (Form NR in the case of. The tax treatment for cryptocurrency held by non-resident aliens (NRAs) in the United States differs significantly from that of residents. All taxpayers filing Form , Form SR or Form NR must check one box answering either "Yes" or "No" to the virtual currency question.